What are Net Operating Losses?

Net Operating Loss (NOL) carryforward is a tax provision that allows businesses having losses in a taxable year to carry those losses forward and deduct them from future years’ profits.

The ability to carry losses forward particularly benefits two types of businesses, both of which are critical to our economy:

- Start-up firms (including those in technology or biosciences) often experience significant losses in early years that could be reinvested by reducing future tax liabilities if they become profitable.

- Employers that operate in cyclical business cycles, such as manufacturers in the commodity markets like metals, chemicals, or pulp and paper, where profits and losses can fluctuate greatly.

How Pennsylvania Compares

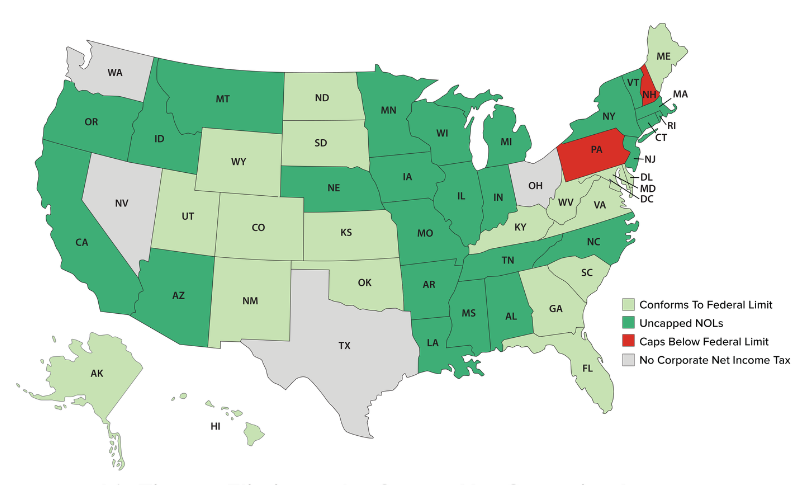

Pennsylvania currently caps a business’s NOL carryforward deduction at 40 percent of taxable income. We are one of only two states that cap NOL deductions below the federal limit of 80 percent of taxable income. There are 19 states that align with the federal rules, while 25 states have no deduction cap at all.

Which State Would You Choose?

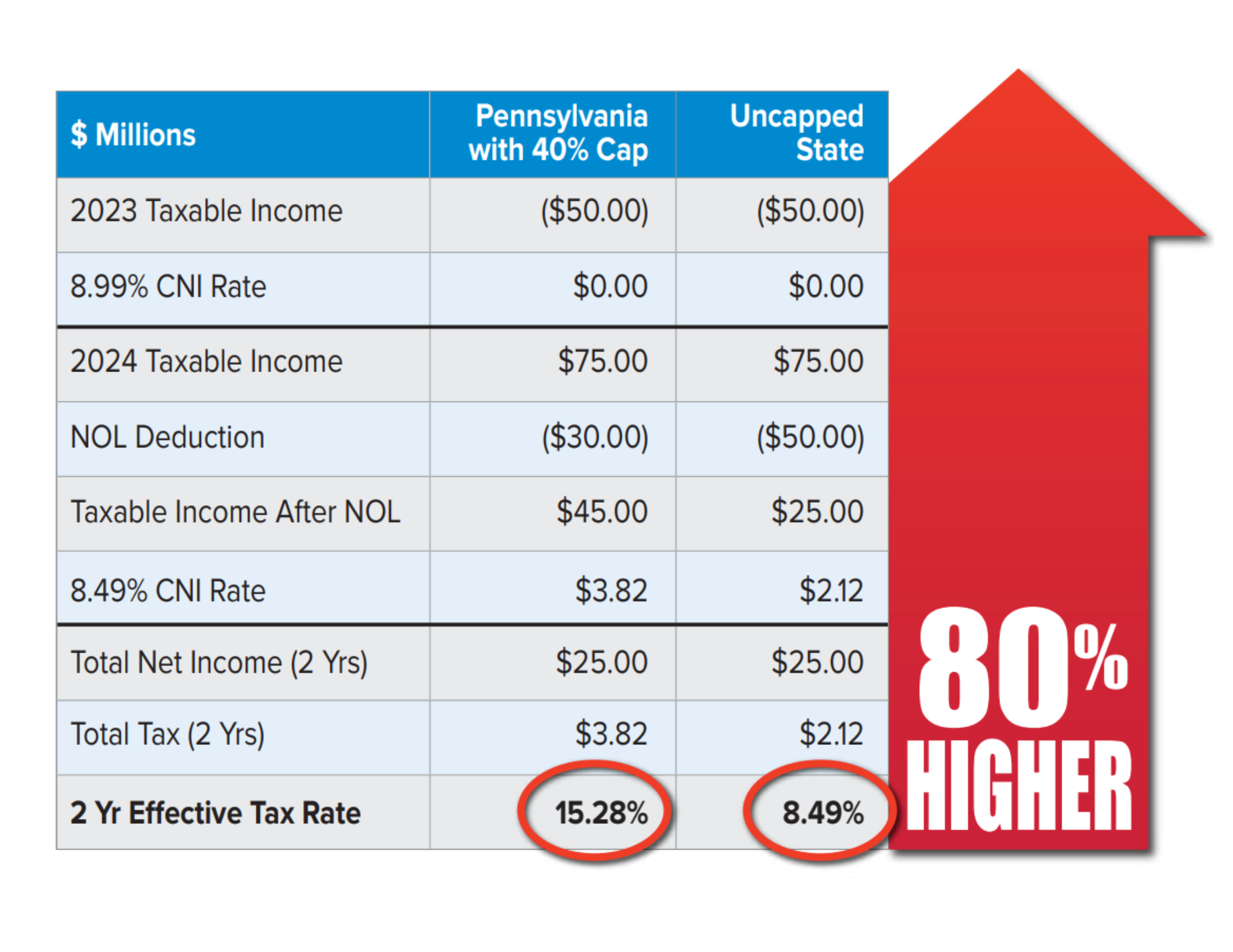

Consider a hypothetical start-up company that has a choice to do business in Pennsylvania or in another state that has the same tax rates as Pennsylvania. In its first year of operation (2023), the Company had significant start-up costs and recorded a $50 million loss. Once the business started generating sales, they earned a $75 million profit in 2024.

Under Pennsylvania’s uncompetitive NOL rules, the company is limited to reducing their taxable liability in 2024 to 40 percent of their taxable income ($75M x 40% = $30M). Unable to deduct the full amount of losses carried forward from the previous year, they end up paying $3.82 million in taxes, an effective tax rate of 15.28 percent!

In the other state, the company can deduct up to 80 percent of taxable income ($75 x 80% = $60). Because this amount is greater than the $50 million loss carried forward from the previous year, the company can deduct the full $50 million loss. This results in a total tax liability of $2.12 million, or an effective tax rate of 8.49 percent.

If you had the option between two states to start a company, would you choose Pennsylvania where you will pay $1.7 million more in taxes and an effective tax rate that is 80 percent higher?

What Employers Are Saying

[Insert testimonial graphics here]

Improving our Tax Climate

NOL deductions promote a fair tax system by reducing additional tax burdens on entrepreneurial risk, cyclical businesses, or those more susceptible to economic downturns. Pennsylvania is a national outlier in its harsh treatment of losses. Fixing this flaw will promote future growth, provide more stability as businesses make long-term investment and hiring decisions and make Pennsylvania more attractive to employers and entrepreneurs.