Lawmakers ended a protracted budget stand-off last week by completing the final two components of the FY 2023-24 budget legislation. Several programs funded in the budget earlier this year had been held up, pending passage of Fiscal Code and School Code legislation. With these two components passed and signed by the Governor, the FY 2023-24 budget is finally complete.

Lawmakers ended a protracted budget stand-off last week by completing the final two components of the FY 2023-24 budget legislation. Several programs funded in the budget earlier this year had been held up, pending passage of Fiscal Code and School Code legislation. With these two components passed and signed by the Governor, the FY 2023-24 budget is finally complete.

While much of the text in these code bills involves nuanced direction on how state appropriations are to be spent, there were several provisions included that are of particular interest to the employer community:

Education Improvement Tax Credit

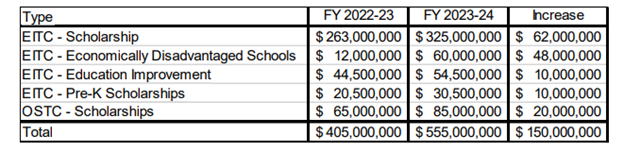

The Education Improvement Tax Credit (EITC) and the Opportunity Scholarship Tax Credit (OSTC) programs were increased by a total of $150 million. This includes:

Childcare

- The PA Child and Dependent Care tax credit was increased from 30 percent of the federal credit to 100 percent of the federal credit, up to $3,000 for one dependent and $6,000 for two or more.

- Lawmakers also excluded amounts paid by an employer for child or dependent care assistance for an employee from the employee’s gross income for tax purposes.

911 Fee Increase

- The 911 fee on phone lines and cell phones was increased from $1.65 to $1.95, effective March 1, 2024.

- A study will be conducted by the Legislative Budget and Finance Committee to review efficiencies, potential consolidations, the use of innovative technologies, and operations and funding sources in other states.

- The governor had proposed an increase to $2.03.

- The governor also proposed eliminating the gross receipts tax and sales tax on cell phones, which was not included.

Unemployment Compensation Service and Infrastructure Improvement Fund

- Lawmakers authorized a transfer of $65 million from the Unemployment Compensation Trust Fund to the Service and Infrastructure Improvement Fund to support service upgrades and operations of the unemployment compensation system. The PA Chamber defeated an earlier proposal which would have provided unlimited authority for the Secretary of Labor & Industry to transfer funding from the UC Trust Fund to pay for administration costs.

- Annual reports on the use of the funds will be required.

Combating Organized Retail Theft

Businesses large and small are facing rising occurrences of retail theft and organized retail theft. Legislation championed by the PA Chamber to combat this growing problem was signed into law last week.

Act 42 of 2023, which was sponsored by Sen. Dave Argall (R-Schuylkill) will establish an office of Organized Retail Crime Theft within the Attorney General’s office to investigate and prosecute cases of organized retail theft. The new law also lowers the existing thresholds for felony offenses. The threshold for a third-degree felony was cut in half, from $5,000 to $2,500 of goods in possession of a retail theft organization, while the threshold for a second-degree felony was also cut in half, from $20,000 to $10,000. A new first degree felony offense was also established for a retail theft organization in position of more than $50,000 in goods.

According to the U.S. Chamber of Commerce, retail crime costs businesses in Pennsylvania over $7.7 billion in lost product costs, higher insurance, increased price of goods, and unrealized wages and accounts for over $1.2 billion in lost tax revenue to the state and local governments.

Act 42 was signed alongside another measure that would create a new offense for stealing mail, a measure that was introduced to crack down on “porch pirates.”

Clean Slate, Probation Reform

House lawmakers voted 150-53, and Senators voted 47-3, last week to pass House Bill 689, legislation to expand Pennsylvania’s first-in-the-nation Clean Slate legislation and extend automatic criminal record sealing to certain low-level, non-violent felony drug offenders who remain crime-free for a set period of time following incarceration.

Separately, the House voted 178-25, and the Senate voted 48-2, to pass Senate Bill 838, legislation to update and improve Pennsylvania’s probation law by incentivizing individuals on probation to pursue education and job training programs. The legislation also limits when a technical violation can result in the revocation of one’s probation and directs courts to consider a probationer’s work schedule when scheduling confinement in the event of revocation of probation.

The PA Chamber supported both bills as part of our multifaceted workforce development agenda to encourage employment, particularly among marginalized populations, and applauded lawmakers for passing them with bipartisan support. Both proposals have been signed into law by Gov. Shapiro.